where's my unemployment tax refund

Since the IRS began issuing refunds for this it has adjusted the taxes of 117 million people sending out 144 billion overall. Unemployment tax refunds started landing in bank accounts in May and will run through the summer as the IRS processes the returns.

How Is Unemployment Taxed Forbes Advisor Forbes Advisor

Calling the IRS at 1-800-829-1040 Wait times to speak to a representative may be long Looking for emails or status updates from your e-filing website or software.

. Using the IRSs Wheres My Refund feature. Account Services or Guest Services. The unemployment tax refund is only for those filing individually.

Ad Learn How Long It Could Take Your 2021 Tax Refund. Viewing your IRS account information. COVID Tax Tip 2021-87 June 17 2021 The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. Those payment were originally refundable credits and then when the 2020 rescue act kicked in it made them nontaxable. Check The Refund Status Through Your Online Tax Account.

Unemployment Refund Tracker Unemployment Insurance TaxUni. If you did NOT PAY taxes on your unemployment and received your full 60000 weekly UI payments you will not be getting the unemployment refund. Whether you owe taxes or are awaiting a refund you may check the status of your tax return by.

If youre anticipating an unemployment tax refund your best bet is to track the status of it and see. Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. Over 50 Million Returns Filed 48 Star Rating Claim all the credits and deductions.

These are called Federal Insurance. Viewing the details of your IRS account. These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset the debt.

Check For the Latest Updates and Resources Throughout The Tax Season. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. You may check the status of your refund using self-service.

Federal law requires employers to withhold taxes from an employees earnings to fund the Social Security and Medicare programs. Another way is to check. Ad Learn About the Common Reasons for a Tax Refund Delay and What To Do Next.

The first phase included the simplest. The IRS has sent 87 million unemployment compensation refunds so far. IRS sends out another 430000 refunds for 2020 unemployment benefit overpayments.

This is the fourth round of refunds related to the unemployment compensation. All totaled officials say they have identified 16 million people who are eligible for the adjustment. There are two options to access your account information.

Again anyone who has not paid taxes on their UI benefits in 2020. COVID-19 Related Tax Information COVID-19 Teleworking Guidance Updated 08032021 The Divisions telephone based filing and inquiry systems will be down beginning. Using the IRS Wheres My Refund tool.

If you use Account Services. Ad Pay 0 to File all Federal Tax Returns No Upgrades 100 Accurate. See How Long It Could Take Your 2021 Tax Refund.

The IRS says eligible individuals shouldve received Form 1099-G from their state unemployment agency showing in. The exact refund amount will depend on the persons overall income jobless benefit income and tax bracket.

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

1099 G Unemployment Compensation 1099g

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Composing A Financial Contingency Plan Taxes Humor Emergency Fund Financial

Some 2020 Unemployment Tax Refunds Delayed Until 2022 Irs Says

.png)

Where Do I Find My State Unemployment Tax Form To Print For Filing I Only See 1 Form In Archived Filings And That Is For The 2nd Qtr 2020

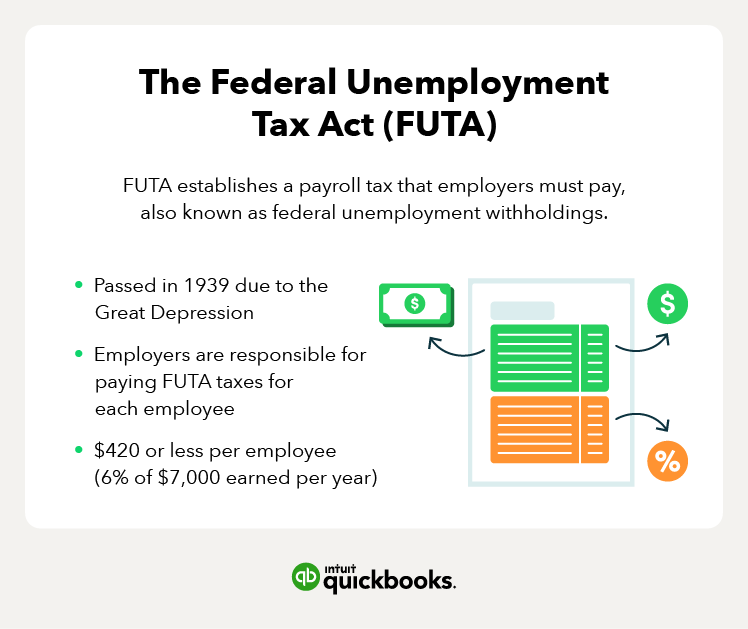

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks

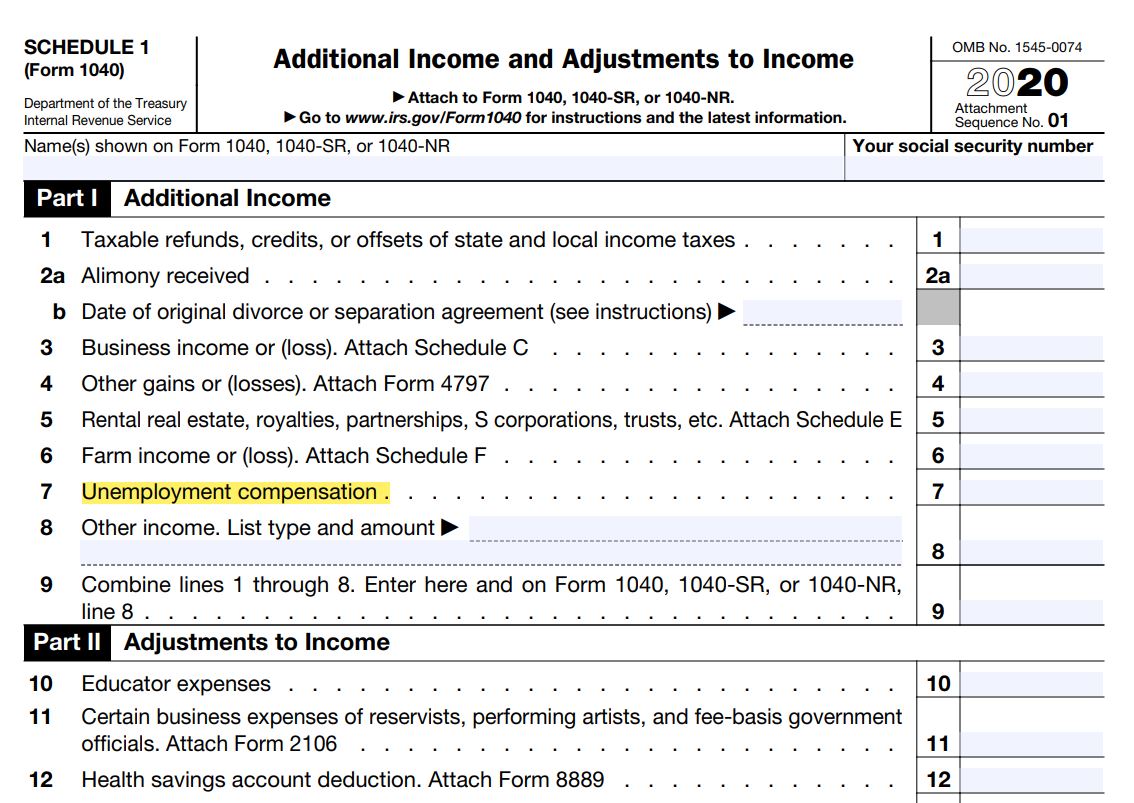

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

Stimulus And Taxes How To Shield Up To 10 200 In Unemployment Benefits From Income Taxes Syracuse Com

Unemployment Tax Refund Update What Is Irs Treas 310 Abc10 Com

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Unemployment Taxes Will You Owe The Irs Credit Com

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment The Us Sun

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

:max_bytes(150000):strip_icc()/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

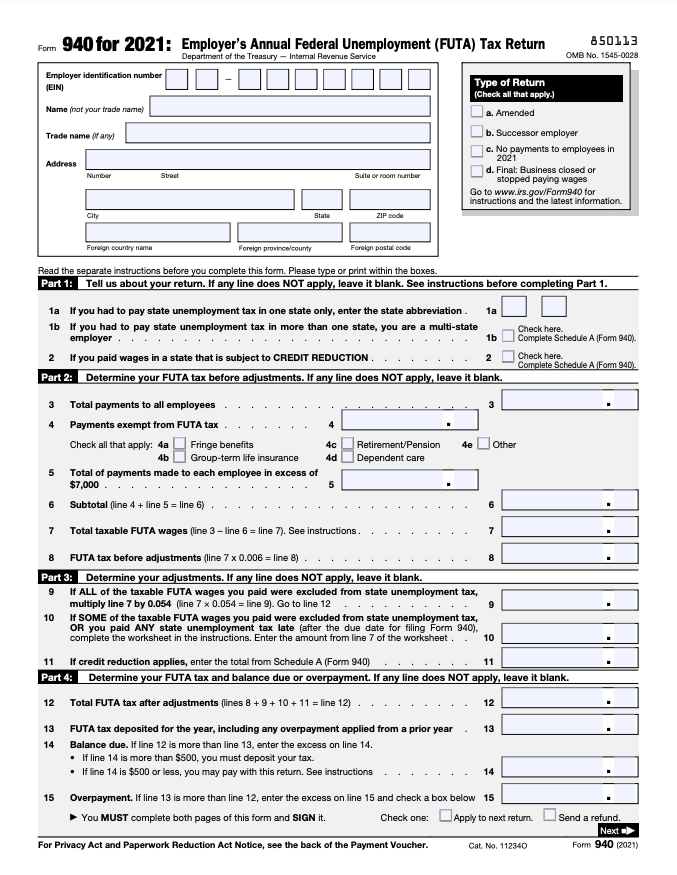

Form 940 When And How To File Your Futa Tax Return Bench Accounting