pay indiana business taxes online

The Republican chief executive outlined a plan Thursday for Indiana to pay 225 to all adult Hoosiers in July or August on top of the 125 automatic taxpayer refund payments already going out. You may pay your taxes by calling 1-877-690-3729 with Jurisdiction Code 2446.

Sales Tax Is Called A Regressive Tax Because People Who Make Less Money End Up Spending A Larger Portion Of Their Pay Infographic Math Review Finance Investing

When you register an account you are able to enjoy the benefits of the following information being stored.

. Unfortunately in recent years the State of Indiana has been very slow in sending that information to the Decatur County Treasurer. You can make online payments 24 hours a day 7 days a week up until 1159 pm. Please note that payments made through this system may take up to five business days to reflect on your tax bill.

SBAgovs Business Licenses and Permits Search Tool allows you to get a listing of federal state and local permits licenses and registrations youll need to run a business. The State of Indiana sends Decatur County the information needed to prepare the property and real estate tax bills. Beverly Bird has been a writer and editor for 30 years covering tax breaks tax preparation and tax law.

She also worked as a paralegal in the areas of tax law bankruptcy and family law from 1996 to 2010. Learn Indiana income property and sale tax rates so that you can estimate how much you will pay on your 2021 taxes. Taxes are due and payable in two 2 equal installments on or before May 10 and November 10.

Claim a gambling loss on my Indiana return. ATTENTION-- ALL businesses in Indiana must file and pay their sales and withholding taxes electronically. If you work in or have business income from Indiana youll likely need to file a tax return with us.

You will need your Assessors Identification Number AIN to search and retrieve payment information. Know when I will receive my tax refund. Whether you have to pay sales tax on Internet purchases is a common question in a world where consumers buy everything from clothes to food to cars online.

Have more time to file my taxes and I think I will owe the Department. Whether youre a large multinational. County Rates Available Online-- Indiana county resident and nonresident income tax rates are available via Department Notice 1.

Some people view the Internet as the prime place to start selling items that are free from sales tax. INBiz can help you manage business tax obligations for Indiana retail sales withholding out-of-state sales gasoline use taxes and metered pump sales as well as tire fees fuel taxes wireless prepaid fees food and beverage taxes and county innkeepers taxes. Indeed many online retailers often lure customers in by advertising that any purchases made will be free.

Indiana businesses have to pay taxes at the state and federal levels. If you are an employee your employer withholds income taxes from each paycheck based on a completed W-4 Form. Responsibility for the assessment of all personal property throughout Maryland rests with the Department of Assessments and Taxation.

Pay your taxes online using your checking account or creditdebit card. Tax Rate Chart 2021 Pay 2022. Various Vigo County offices coordinate the assessment and payment of property taxes.

But if you are self-employed or make money on your investments or rental property you may need to make estimated tax payments every quarter rather than wait until you file. Pay my tax bill in installments. Advance of Taxes to other units of government within county ie.

Small Business Administration - Indiana State Agency List Indiana Small Business Development Center Department of Administration - Procurement Division myLocalINgov. In Maryland there is a tax on business owned personal property which is imposed and collected by the local governments. Pay your Tax.

INtax only remains available to file and pay the following tax obligations until July 8 2022. Usually thats enough to take care of your income tax obligations. Indiana state income tax rate is 323.

Find Indiana tax forms. Business Personal Property Taxes. Take the renters deduction.

Your Account Information-When you have an account your parcels payment and contact information will all be stored securelyYou will not have to. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Marion County Indiana offers residents to view and pay their property tax bills excluding judgments online.

Under Indiana Code 5-13-7-6 the Local Board of Finance which includes the County Board of Commissioners and the County Treasurer reviews overall investment policy of the county. Business Personal Property Taxes. If youre running a service business that does between roughly 56000 and 112000 in annual revenues or a manufacturing wholesaling or retailing business that does between roughly 170000 and 340000 you get a small credit that will wipe out part of.

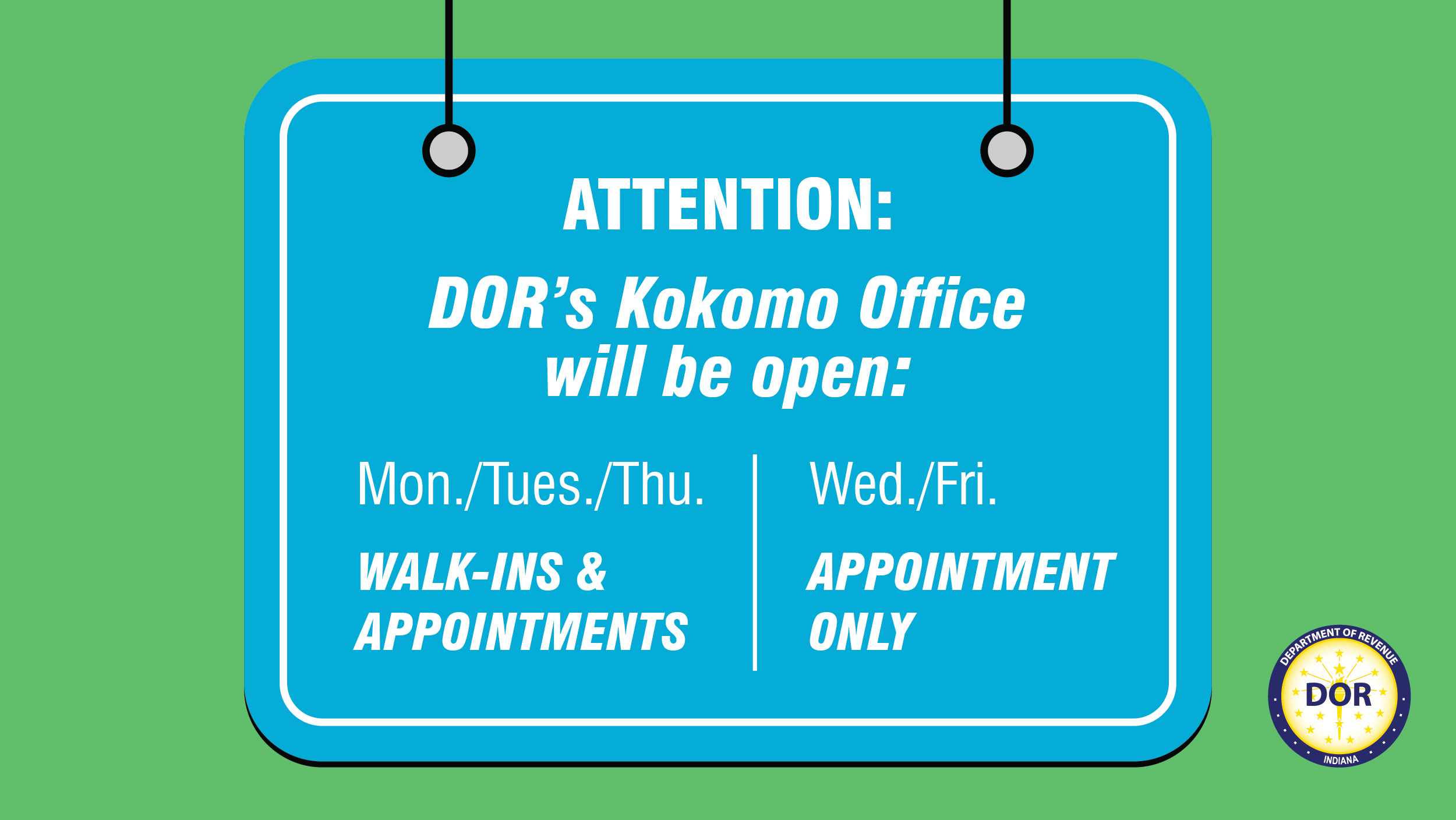

The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov. Certificate of Deposit. Pacific Time on the delinquency date.

Indiana Tax Id Online Application How To Apply For A Tax Id Ein Online Business Learning Center

Indiana Dept Of Revenue Inrevenue Twitter

Indiana Will Start Accepting State Tax Returns On Monday Wish Tv Indianapolis News Indiana Weather Indiana Traffic

State Of Ohio Refund Cycle Chart 2014 29 Louisiana State Tax Forms Picture Louisiana State Tax Forms State Tax Chart

Fake Indiana University Bloomington Diploma Indiana University Bloomington Schools In Usa Diploma Online

Free Indiana Payroll Calculator 2022 In Tax Rates Onpay

Indiana Dept Of Revenue Inrevenue Twitter

Indiana State Tax Information Support

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

If You Can T File Or Pay Taxes By Midnight April 15 Here S What To Do Tax Preparation Income Tax Tax Questions

Indiana Sales Tax Small Business Guide Truic

If You Re Suffering From Taxproblems With The Irs And Owe 8 000 Or More In Backtaxes Penalties And Interest Tax Debt Relief Debt Relief Programs Irs Taxes

Indiana Dept Of Revenue Inrevenue Twitter